Social Security Benefits for Married Couples

When Should We Take Our Benefits ?

OVERVIEW: Each spouse is entitled to their individual benefits and spousal benefits. We have to review your individual benefits first.

Individual Collection Decision

COLLECTING BENEFITS AT FULL RETIREMENT AGE

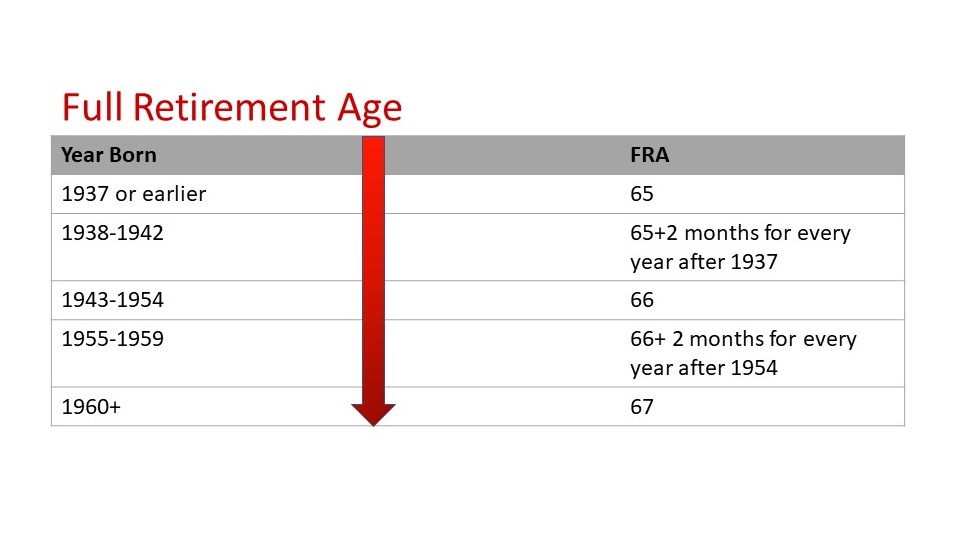

Your benefits, known as your Primary Insurance Amount (PIA) is the monthly benefit for which you are eligible at your full retirement age (FRA). FRA varies based on year of birth. Originally age 65, the federal government has increased FRA for anyone born after 1937 in recognition of longer life expectancies. Life expectancy in 1937 was less than 65. Today, it is about 78. We expect our clients to live even longer.

TIPS

You must have worked for 40 Quarters to be eligible to receive benefits.

Social Security aims to encourage you to collect your benefits at Full Retirement Age, known as FRA in Social Security Language.

Your monthly benefit, known as your Primary Insurance Amount (PIA), is calculated based on your highest 35 years ofemployment

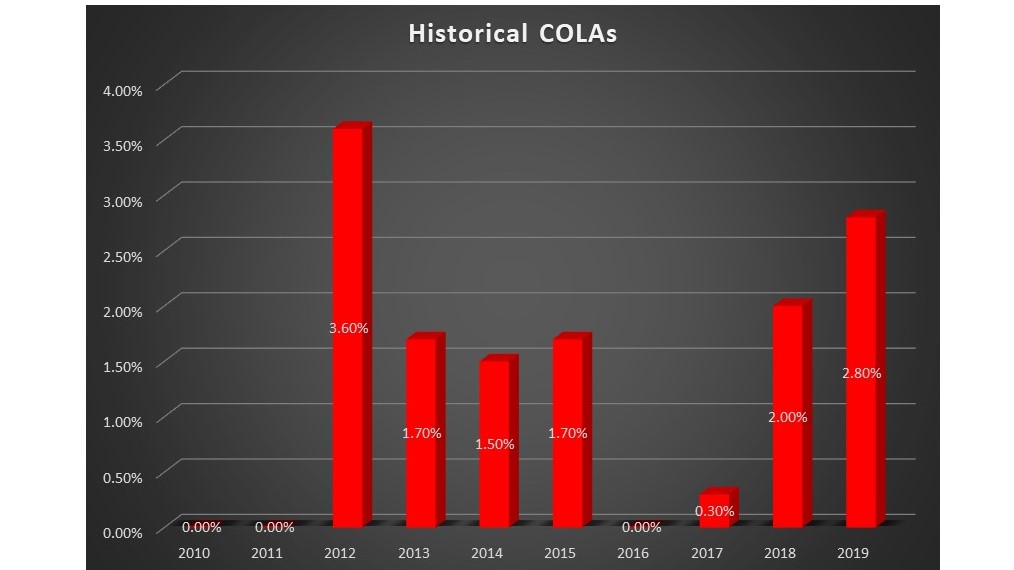

The Social Security Administration (SSA) uses your highest 35 years of employment to arrive at your Average Indexed Monthly Earnings (AIME). For more information, please visit www.ssa.gov to get your Social Security statement. If you continue working after reaching FRA, the SSA will automatically recalculate your benefits each year you continue to work. If your current income is greater than any of your previously calculated “highest 35 years”, your benefits will be adjusted upward. The increase generally will be made in October of the following year, but will be retroactive to January 1. In addition, Social Security retirement benefits are automatically modified each year for inflation, known as Cost-Of-Living Adjustments (COLAs).

TIP

COLAs have averaged between 1% and 2% over the past 10 years. Over the last 90 years inflation has averaged about 3% per year.

TIP

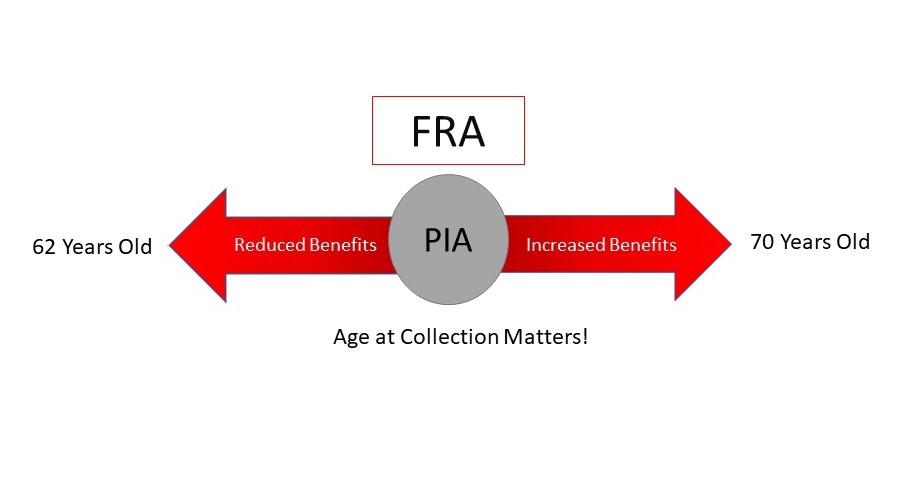

Benefits are reduced by about 6% per year for each year you receive benefits prior to your full retirement age (FRA).

COLLECTING BENEFITS EARLIER THEN FRA

While your full benefit, your PIA, is payable at your FRA, you are entitled to collect benefits as early as age 62. However, if you choose to collect early, you will permanently reduce the size of your benefits. Your benefits will not be adjusted upward when you attain FRA. The amount of your reduction will depend on two factors—your FRA and the number of months before it that you start collecting. If you begin taking benefits on your 62nd birthday, you are subject to the maximum reduction. That reduction will be smaller for each month you delay benefits after age 62 but prior to reaching FRA.

COLLECTION AGE IMPACTS BENEFIT AMOUNT

WORKING WHILE COLLECTING BENEFITS PRIOR TO FULL RETIREMENT AGE

Social Security benefits are intended to supplement retirement income. There are consequences to collecting your benefits early if you are not retired and are still receiving wages. If you choose to collect benefits prior to FRA, you are subject to an Earnings Test every year until you reach FRA.

If your earnings exceed certain thresholds, the SSA will Withhold part or all of your benefits. The earnings test for individual and survivor benefits looks only at the salary or wages of the individual collecting early benefits. It does not consider any other type of income, nor does it consider the salary or wages of a spouse. However, the test on spousal benefits (see memo on Married Couples) may take into account both spouses' wages if both are under age 62.

TIP

Withheld benefits are different and in addition to reduced benefits.

The Withholding on Social Security before FRA eliminates Benefits for many Employees.

WITHHELD BENEFITS

Benefits withheld by the SSA due to early collection will not be refunded. However, your benefits will be adjusted at FRA to account for the benefits that were withheld. For example, if your FRA was 66 and you began collecting benefits at age 62, the SSA would have reduced your benefit by 25%. Assuming you returned to work at age 64; the SSA may have withheld two years’ worth of benefits by the time you reached FRA. The SSA would then lessen your 25% reduction to give you credit for the two years of lost benefits. Your new reduction would be as if you started collecting benefits at age 64 (13.3% reduction) rather than age 62.

2019 RETIREMENT EARNINGS LIMIT

Under FRA

- $1 of benefits withheld for every $2 in earnings above $17,640

- Earned $27,640 – $17,640 = $10,000 over x 1/2 = $5,000 withheld

Year individual reaches FRA

- $1 of benefits withheld for every $3 in earnings above $46,920 for months prior to attaining FRA

- Earned $56,920 – $46,920 = $10,000 over x 1/3 = $3,333 withheld

Month individual reaches FRA

- Unlimited

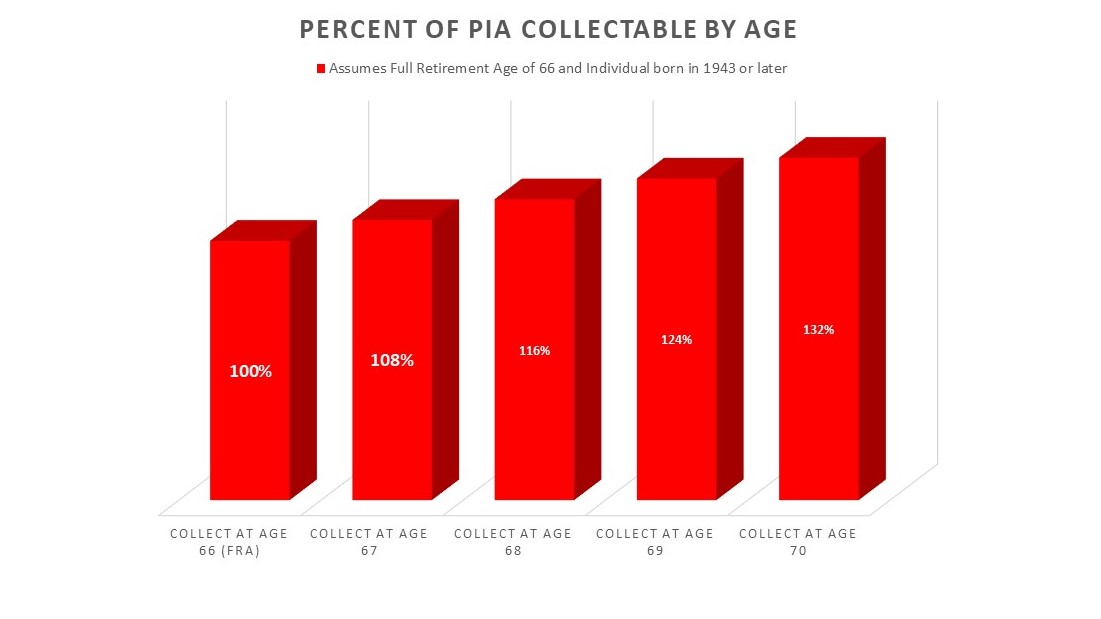

WAITING TO COLLECT BENEFITS

If you elect to defer collecting benefits beyond your FRA, the SSA will give you a delayed retirement credit (DRC) for every month you defer between FRA and age 70, the age at which

your benefits max out. This increase will be in addition to the annual COLA, if applicable. Depending on your year of birth, your increase will amount to 7% to 8% annually.

TIP

The 8% per year increase is greater than the expected return from most investments. In addition, increase applies to Survivor Benefits.

TIP

When collecting before FRA, always consider the net (after-tax) benefits you will receive. A working spouse may cause more of your benefits to be taxed, and at potentially higher tax rates.

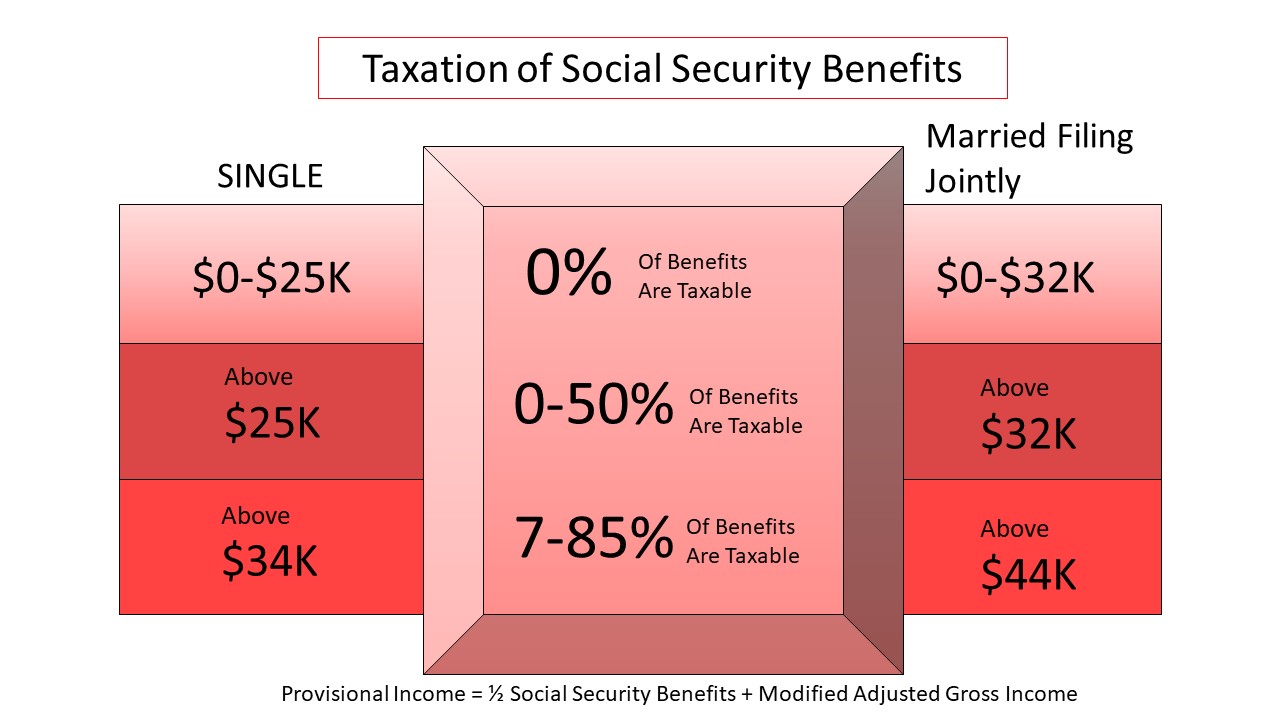

TAXATION OF BENEFITS

You should plan on income taxes on Social Security Benefits. Individuals with high total incomes must include up to 85% of their benefits as income for federal income tax purposes. Special step-rate “thresholds” on Provisional Income determine the amount which you may be taxed. We should plan as if you will pay income tax on your benefits when making the decision.

Spousal Collection Decision

COLLECTING SPOUSAL BENEFITS

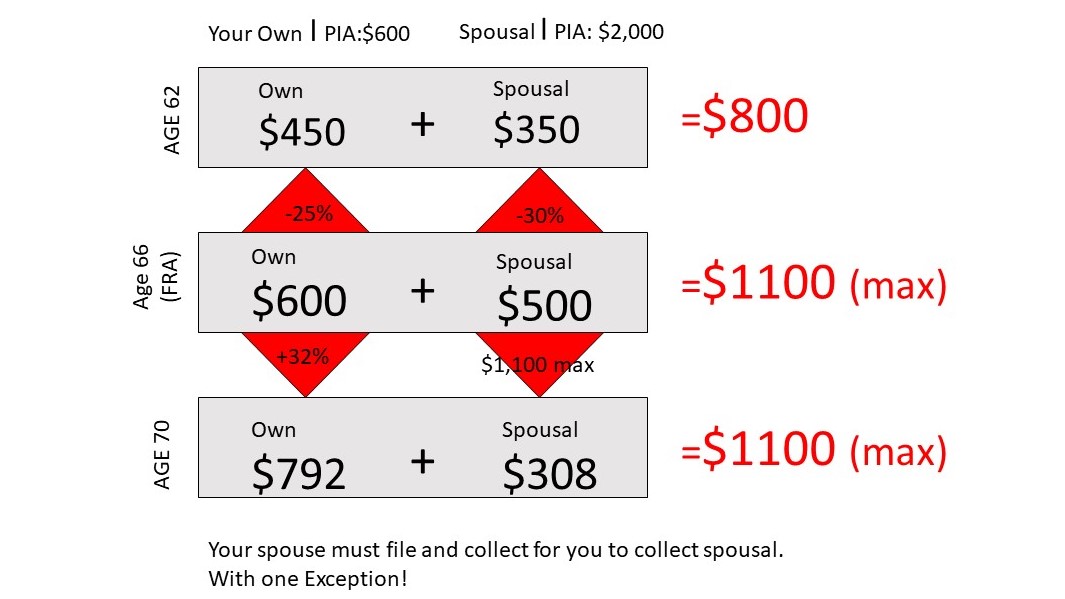

If you are married to an individual who is collecting Social Security retirement benefits and you are at least age 62, you may be entitled to collect spousal benefits. Spousal benefits will be equal to 50% of your spouse’s PIA if you collect benefits at FRA or later. If you are entitled to your own benefits and your PIA is less than 50% of your spouse’s PIA, spousal benefits will be paid in addition to your own. These combined benefits will equal 50% of your spouse’s PIA, assuming you start collecting both benefits at FRA or later.

TIP

Consider collecting your individual benefits first, then spousal benefits once your spouse starts collecting benefits.

COLLECT MORE INCOME BY COMBINING SPOUSAL

AND INDIVIDUAL BENEFITS

COLLECTING SPOUSAL BENEFITS EARLY

If you collect spousal benefits prior to your FRA, your adjusted spousal benefits (amounts in addition to your own benefits) will be reduced. Your spouse’s collection age has no impact on your spousal benefits.

WAITING TO COLLECT SPOUSAL BENEFITS

Unlike your own benefits, spousal benefits are not subject to guaranteed annual increases if you defer collecting them beyond FRA. Spousal benefits are at their maximum when you reach FRA, so there is no advantage to be gained by deferring collection.

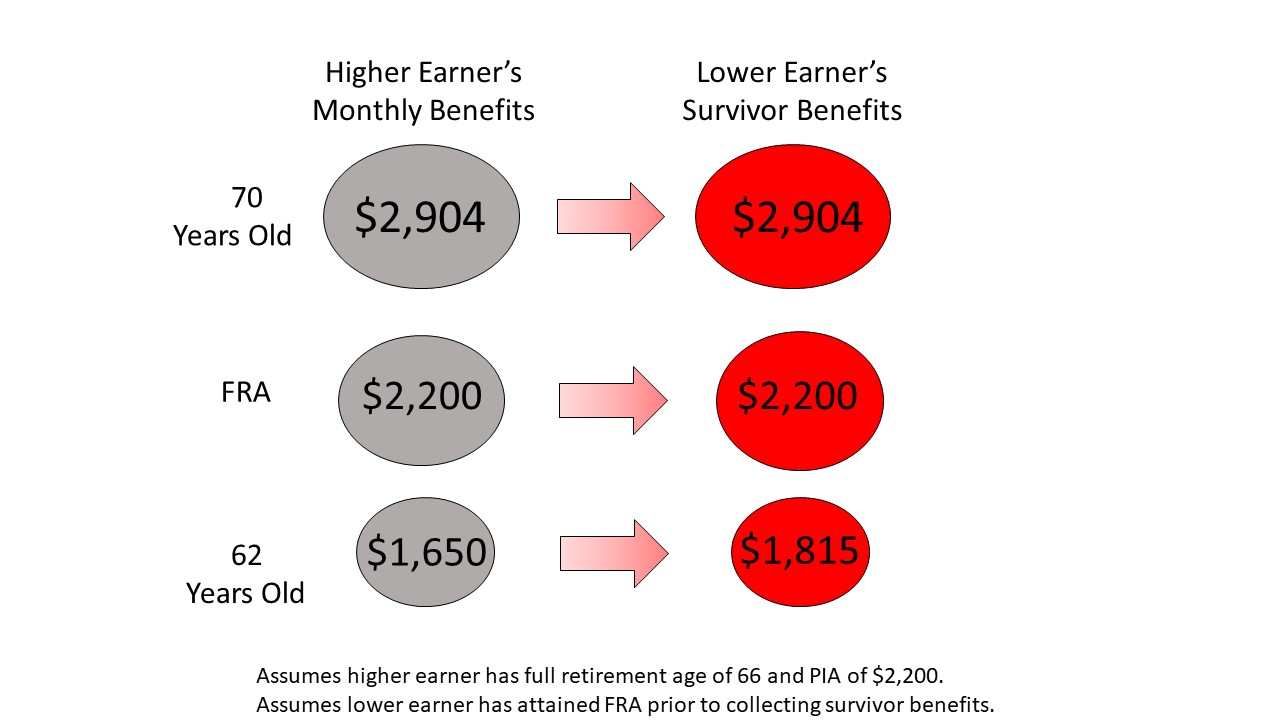

COLLECTING SURVIVOR BENEFITS

If you have been married for at least nine months and your spouse passes away, you may be entitled to survivor benefits. If you remarry before age 60, survivor benefits will not be paid unless the subsequent marriage ends. Remarriage after age 60 does not prevent or stop entitlement to benefits. The amount of your survivor benefits depends on when your spouse began taking benefits. If the death occurs prior to your spouse collecting benefits, your survivor benefits will equal 100% of your spouse’s PIA when you attain FRA. If your spouse was collecting benefits at the time of his or her death, your survivor benefits will equal his or her actual benefits, assuming you have attained FRA. The only exception is if he or she was collecting benefits that were reduced more than 17.5%. In that case, your survivor benefits will be 82.5% of your spouse’s PIA. The survivor benefits, if higher, will replace your other benefits

COLLECTING SURVIVOR BENEFITS EARLY

You can collect survivor benefits as young as age 60. If you collect at age 60, your survivor benefits will be reduced by up to 28.5%.

CHOOSING BETWEEN BENEFITS

If you are entitled to both individual and survivor benefits, you can choose to begin collecting one and then switch to the other at a later date. It is possible to collect reduced survivor benefits at age 60, and then convert to your own unreduced benefits at FRA or later. You also have the option to collect individual benefits and then switch to survivor benefits.